Transaction Advisory Services Things To Know Before You Buy

Wiki Article

The Only Guide for Transaction Advisory Services

Table of ContentsMore About Transaction Advisory ServicesFacts About Transaction Advisory Services UncoveredExcitement About Transaction Advisory ServicesAll About Transaction Advisory ServicesTransaction Advisory Services Things To Know Before You Buy

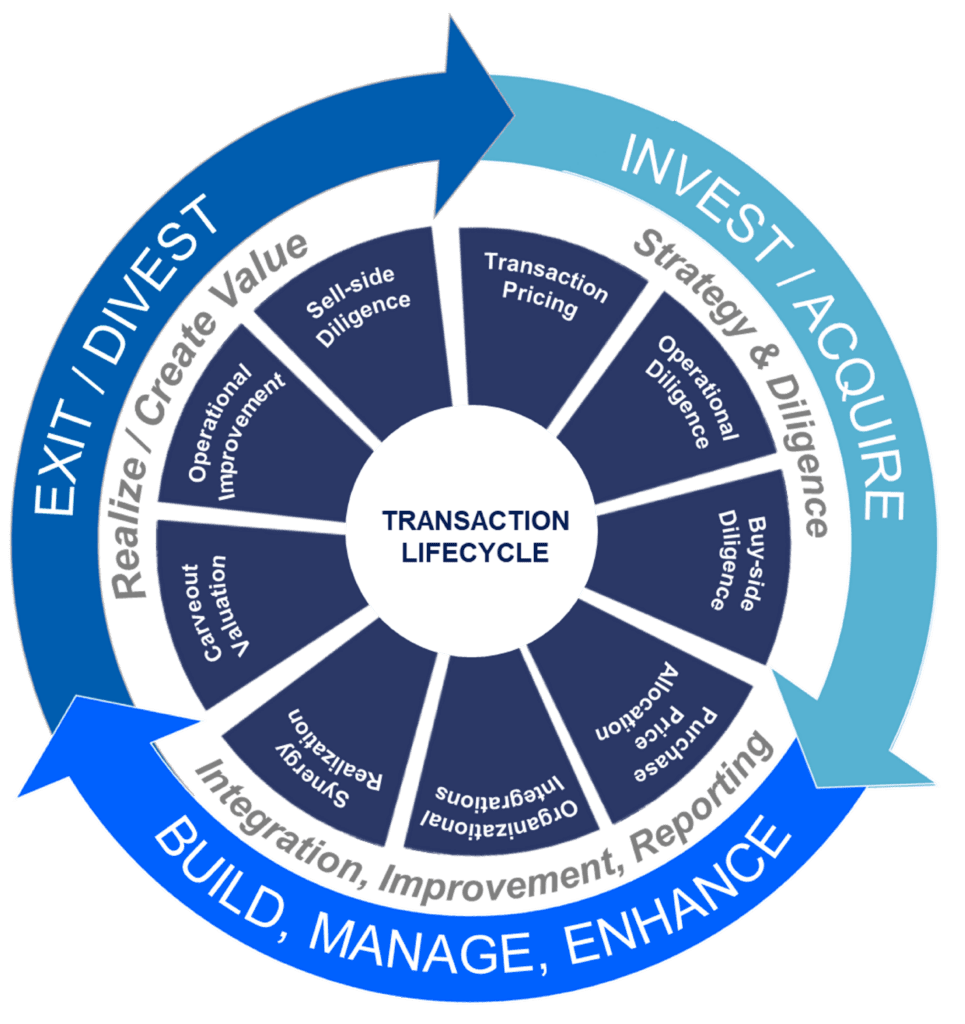

This action ensures the business looks its best to prospective buyers. Obtaining the business's worth right is vital for a successful sale. Advisors use different approaches, like affordable capital (DCF) analysis, comparing to similar firms, and current transactions, to identify the reasonable market price. This helps establish a fair price and bargain properly with future purchasers.Deal experts step in to assist by getting all the needed information arranged, addressing questions from buyers, and organizing sees to the organization's area. Transaction advisors use their experience to aid business owners handle difficult negotiations, meet purchaser expectations, and framework deals that match the proprietor's objectives.

Fulfilling lawful regulations is essential in any type of service sale. Deal consultatory services function with lawful specialists to develop and assess agreements, arrangements, and various other legal documents. This reduces threats and makes certain the sale adheres to the law. The function of deal advisors expands beyond the sale. They assist local business owner in preparing for their next steps, whether it's retired life, beginning a new venture, or managing their newly found riches.

Transaction experts bring a riches of experience and expertise, making certain that every facet of the sale is taken care of skillfully. With strategic prep work, assessment, and negotiation, TAS aids local business owner accomplish the highest feasible list price. By ensuring lawful and regulatory compliance and handling due persistance along with various other deal staff member, transaction consultants reduce prospective dangers and responsibilities.

Getting The Transaction Advisory Services To Work

By comparison, Big 4 TS groups: Deal with (e.g., when a potential customer is carrying out due persistance, or when an offer is closing and the customer needs to incorporate the business and re-value the vendor's Annual report). Are with charges that are not linked to the deal closing effectively. Earn costs per engagement somewhere in the, which is less than what investment financial institutions make also on "little offers" (but the collection probability is additionally a lot greater).

, but they'll focus much more on bookkeeping and assessment and much less on topics like LBO modeling., and "accounting professional only" topics like trial balances and exactly how to stroll with occasions making use of debits and credit scores rather than financial declaration modifications.

Transaction Advisory Services Things To Know Before You Get This

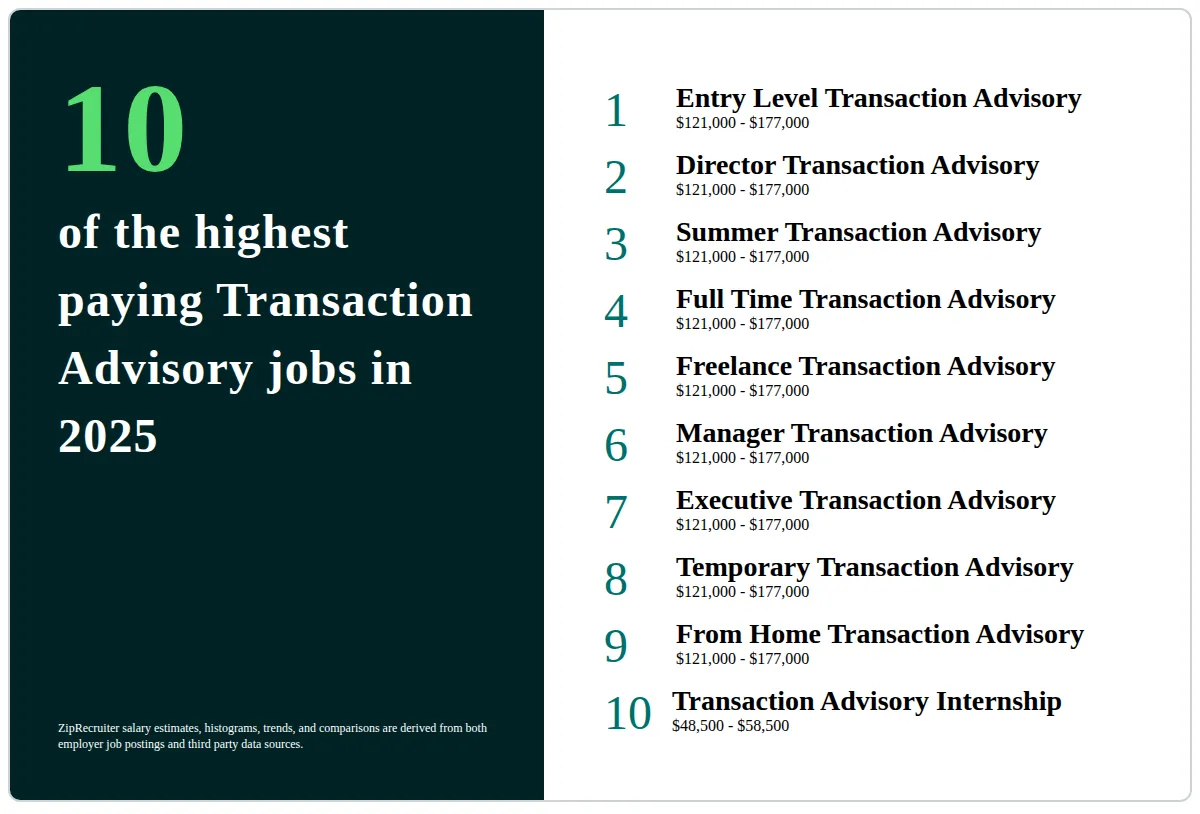

Experts in investigate this site the TS/ FDD teams might additionally speak with administration concerning every little thing over, and they'll write a comprehensive report with their findings at the end of the procedure., and the basic shape looks like this: The entry-level function, where you do a whole lot of data and economic evaluation (2 years for a promo from right here). The following degree up; similar work, but you obtain the even more intriguing bits (3 years for a promotion).

In specific, it's tough to get promoted past the Supervisor level since few individuals leave the work at that stage, and you need to begin revealing proof of your capability to generate income to advancement. Let's begin with the hours and way of living given that those are less complicated to explain:. There are occasional late nights and weekend job, yet nothing like the frantic nature of investment banking.

There are cost-of-living changes, so expect lower settlement if you're in a cheaper area outside major monetary facilities. For all settings except Partner, the base pay comprises the mass of the total payment; the year-end incentive may be a max of 30% of your base income. Commonly, the most effective method to raise your revenues is to switch to a various company and work out for a greater wage and benefit

8 Simple Techniques For Transaction Advisory Services

At this phase, you need to simply remain and make a run for a Partner-level function. If you want to leave, maybe move to a customer and perform their valuations and due persistance in-house.The major issue is that since: You typically need to sign up with an additional Huge 4 group, such as audit, and work there for a couple of years and afterwards move into TS, work there for a few years and afterwards relocate into IB. And there's still no warranty of winning this IB duty since it depends on your area, customers, and the hiring market at the time.

Longer-term, there is also some threat of and since browse around here evaluating a company's historic monetary information is not specifically rocket science. Yes, humans will certainly always need to be entailed, however with more advanced modern technology, lower headcounts can potentially sustain client engagements. That claimed, the Deal Services team beats audit in regards to pay, work, and leave opportunities.

If you liked this write-up, you could be interested in analysis.

The Transaction Advisory Services PDFs

helpful site

Establish advanced monetary frameworks that aid in establishing the real market price of a company. Give advising operate in connection to company assessment to assist in bargaining and pricing structures. Explain one of the most ideal type of the offer and the type of consideration to employ (cash money, supply, make out, and others).

Establish activity strategies for danger and exposure that have actually been recognized. Do integration planning to establish the procedure, system, and organizational changes that might be called for after the offer. Make numerical price quotes of combination expenses and benefits to analyze the financial reasoning of combination. Set standards for integrating divisions, modern technologies, and company processes.

Recognize potential decreases by reducing DPO, DIO, and DSO. Examine the potential client base, sector verticals, and sales cycle. Consider the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The functional due diligence uses vital insights right into the performance of the firm to be gotten concerning danger analysis and value development. Identify short-term alterations to funds, banks, and systems.

Report this wiki page